Introduction

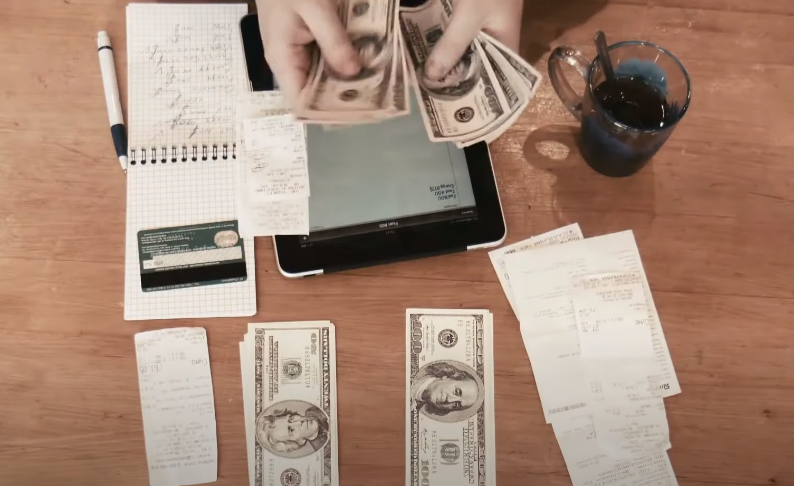

You’ve just received your paycheck, and your eyes light up at the sight of your hard-earned money.

But then a sense of confusion sets in. How much should you spend? How much should you save? And how do you balance your immediate desires with your long-term financial goals?

If these questions often cross your mind, you’re not alone. Many of us grapple with these decisions every payday.

But what if I told you there’s a simple rule that can help you manage your money more effectively?

Overview of the 50/30/20 Rule

The 50/30/20 rule is a budgeting guideline that divides your after-tax income into three categories: needs, wants, and savings.

The idea is to allocate 50% of your income to needs, 30% to wants, and the remaining 20% to savings.

The beauty of this rule lies in its simplicity and adaptability. It’s designed to provide a balanced financial framework that can be tailored to fit different income levels and financial goals.

Detailed Explanation

Needs: 50%

This category should comprise no more than 50% of your after-tax income. What exactly qualifies as a need? Needs are the bills and expenses that are essential for your survival and well-being.

They are the things you can’t avoid paying for, no matter what. This includes your rent or mortgage payments, utilities like electricity and water, groceries to feed yourself and your family, health insurance, and basic transportation costs.

If you have a car, this would include your car payment, gas, and auto insurance.

If you use public transportation, this would be your fare or pass. Remember, these are not luxuries or nice-to-haves; these are the must-haves, the non-negotiables.

Wants: 30%

This category is allocated 30% of your income.

They are the things that bring you joy and make life more enjoyable, but you could live without them if necessary.